Today, there are many multinational companies spread across the globe and current world trade mostly consisted with the relations within the multinational companies. However, with the start of the age of globalization, some of these multinational companies arise as a blue-chip company, in other words well-capitalised, well-known and well-established companies, alongside with the other sectoral magnets, especially in construction and supply chain services, with giant revenues, which can be compared as industrial magnets of the 19th century. In classical finance, it can be considered for states that are obtain such powerful companies had good revenues through taxation. However, the picture is the quite opposite. Most of the blue-chip companies or sectoral magnets established offshore systems that gridlocked the state’s taxation principles. For example, despite the companies great profits, state’s are generally unable to collect its taxes due to very hideous trick; in most of the company establishment processes, parent companies that are establishing their subsidiary or real persons who will became shareholder to the company through equities, contracting a loan to the company, which neutralise possible dividend distribution taxes due to state, in its inner mechanism, see it as a debt and give priority to the repayment of the debt to the certain companies or persons.

On the other hand, multinational companies’ inner relations are also problematic due to certain reason; in most of the time they do not regulate their prices in accordance with the market principles. Such company policies, constant avoidance of tax, not regulation inner service prices etc. was neglected by the states due to certain reasons until the financial crisis of 2008-9. However, with the certain fiscal deficiencies arose after the financial crisis, states turned their eyes to the this companies due to very certain reason; they needed resource in order to re-organise their economic environment. In order to do that, they started to develop certain policies. In this paper, I will articulate these policies within the two-particular subject, transfer pricing regulations and the BEPS Action Plan. However, as George Orwell stated, some countries are more equal than others.

Such actions taken by the core countries of the world, in order to regain their fiscal strength against the changing world-economy. As reader may understand, companies that will affect from these action plans are mostly Western-oriented, techno-capital intensive companies that at least have one headquarters in Western countries. In order to regulate these companies’ taxation, alongside with the other categorised companies, core states developed such important action. In order to explain that, I will start with the explanation of the state-tax-company triangle, and show that, how revenue system and multinational company activities strengthened the core countries fiscal position in the international system. Secondly, I will show the correlation between the rise of the anti-tax avoidance rules and the 2008 Financial Crisis and show that, how core states found themselves fiscally fragile and in order react developed such policies. At the last part, I will briefly demonstrate that the while core states are able to conduct such policies, peripheral countries are unable to cope with such action plans and how capital transfer emerges through such cycle of BEPS plans. My thesis will hold that, terminologically global actions against tax-avoidance is hideously provide a fiscal imperialism between the core and periphery, while core states benefiting from such anti-avoidance rules, peripheral countries lost such advantages due to two reasons; first of all, they constantly lack of capital in order to development, however, with the rise of such anti-avoidance rules, they might lost one their revenue resources due to group company procedures followed by the BEPS Plan, secondly, peripheral countries lacks adequate state capacity in order to cope with these rules, and this will ended up with more developmental problems against the core.

A) State-Tax-Company: Holy Triangle

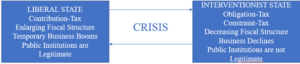

Writers such as Schumpeter (1918) and Goldscheid (1917), believed that the emergence of the taxation in the Western Europe due to three reasons: legal-rational bureaucratization, capitalism and complexity of the division of labour. Moreover, according to the Mann (1943, p. 226), tax exercise three forms of social control, correction of socially undesirable human behaviour, readjustment of economic power between social groups and classes, and combatting the social abuses of capitalism and facilitating the transition to another economic order. On the other hand, in the historical context, early parliamentarian forces, mostly used their legislative power thorough amendment of the taxation policies of the states. Furthermore, historical construction of the European modern states, based on the tax perspective, can be conceived as a dialectic between the obligation (the King’s law based on a sovereignty right) and the legitimate contribution to policy (O’Connor, 1973). In order to examine the state’s role and contributors’ position in the given system, two important typology emerged across the fiscal sociology as follows;

| Tax Level | Intervention level | Low | High | |

| Low | LIBERAL STATE | TAX STATE CRISIS | ||

| High | WASTEFUL STATE | INTERVENTIONIST STATE | ||

| Invisible-Tax | It is not a social representation (for example, but not always, indirect taxes: VAT…) |

| Tribute-Tax | The felt tax burden is intolerable |

| Constraint-Tax | The felt tax burden is too heavy |

| Obligation-Tax | Tax paid to public authorities (one of the two bases of the formation of the tax State in Europe): legal concept |

| Exchange-Tax | Price paid by the taxpayer for the benefit (services) which he receives from the society: Economic concept |

| Contribution-Tax | Taxpayer judges it legitimate to finance public institutions or policies: Political form of tax consent |

In terms of the company-state relations, we need to take into considerations of three specific concept in these definitions: liberal state, interventionist state and obligation-tax. First of all, the “liberal State” with its low level of tax and public interventions is that of the European economy of the nineteenth century. Liberal traditional finances express the will to limit the role of the State for political and economic reasons. It is the apology for the State limited to its sovereignty functions (diplomacy, defence, justice…): it is the reign of economic competition and of the (supposed) invisible hand of market to ensure prosperity. The tax State is limited by the prohibition of economic and social interventions, and it is also neutral with regards to economic decisions.

In the English tradition, following Smith and Ricardo, tax has a strictly financial role consisting in covering the limited expenditure of the State. On the other hand, if we turn our eyes to the other scholars, during the 13th century, Ibn Khaldun stated very important claims regarding the ideal position of the state regarding the tax. According to the Ibn Khaldun, tax increases done by state in order to finance the state expenditures have two outcomes (Ibn Khaldun, 1978). In the short term, such tax policies increase the state’s revenue, however, in the long-term increase of the tax rates will consequence with the decline of the state revenues due to discouragement of the producers and merchants in the economy because it is too much for the establish sustainable economic environment (Ibn Khaldun, 1978). Ibn Khaldun, furthermore, have a cyclic approach for the tax policies, while in the peripheral level, or in the early stages of the state establishment, tax rates are low, due to other sources of revenue still enlarging, in other words conquests or benefit from the trade routes, however, as well as the time pass, once the state establishment is completed and state needs more revenues in order to maintain itself, as a core, tax rates sharply increase and left business men no choice but leaving their production facilities (Ibn Khaldun, 1978). However, more can be analysed in this deterministic approach. As we can see, businessmen left their production capital, but where they move on?

Answer is simple; they moved on investing mechanisms and financial markets. During the 13th century, due to lack of adequate capital markets, old production capital-owners turned their eyes to the one simple thing; interest-bearing loans that give advantage for the capital-owners. In this regard it is very clear that, increase of the interest-bearing loans also plays very crucial role in the decline of the states or re-peripheralization of the states. We can conclude our idea that the, rise of the interest as a beneficial mechanism in capital production is strictly correlated with the tax policies of the state hence tax is playing very crucial role in the business schemes. Such a policy even now can be seen in Turkey. In most of the company establishment process, capital-owners choose to use shareholder loans for the establishment of the company in order to avoid taxation and benefit from the interests paying by the company due to “debt” derived from the loan. Turkish administration, starting with the 2018, enabled interest deduction for the capital in cash contributions for the shareholders.

Our second important concept is the interventionist state. Interventionist states emerged due to crisis periods. The crisis is more a process than a causal datum. In line with cognitive rationality, the crisis is employed as an argument to justify a rise of taxes. Interventionist states are arise from this crisis, in other words, interventionist states are able keep to taxes high in order to avoid financial crisis and recapitalise the economy, in order to maintain their role as a habitat-provider (Martin and Mehrota and Prasad, 2009). Habitat-provider can be understood in many forms. Based on the Parsons writings on the social systems, Parsons believed that the state-individual relations sustained through the concept of satisfaction, if the satisfaction endangered state also fall into the risk zone (Parsons, 1964).

In our case, citizens, who are regular taxpayers, only feel the satisfaction if the state is able to sustain their daily needs, for example bus rides or basic infrastructures, and such sustainability only maintain through the taxes, due to reason that states do not have own any kind of company for profit as another revenue source. In this regard, based on the satisfaction maintenance, states are the habitat-providers that sustain that habitat through the taxes. Such taxes increase especially on the crisis times, such as wars or recessions, in order to maintain satisfactions of the ordinary citizens in order to remain legitimate. However, in the long run, such interventionism ended up with the massive tax burdens, which were contribution-taxes turn into the constraint-tax and obligation-tax. This is also another perspective for the deterministic approach Ibn Khaldun maintained in his book Muqaddimah. Reader may find cyclic stream between the liberal state and interventionist state as follows.

Last important concept is the obligation-tax. it is unilateral act of a sovereignty nature implying a financial levy of a public authority without counterpart. However, only jurist perspective is not adequate for the explanation of the obligation-tax. Constraint-tax” and “tribute-tax”, situations in which the tax burden is regarded as intolerable, are of course to be proscribed because they encourage tax evasion or revolt. If the perceived constraint is low, tax constitutes an obligation, but if the constraint is too strong, tax is considered as an arbitrary “tribute” (called thus in reference to Roman history) (Webber and Wildavsky, 1986). “Tribute-tax” can lead to anti-tax reactions because of its objective financial weight, but also if it is perceived as unfair. Such perspective can be applied to the corporate-state relations in terms of the corporate income tax. US was the one of the first introduced the corporate income tax to the corporate legal personalities around the world, in 1894, however, such enactment later found unconstituonal by the courts (Seidman, 2004).

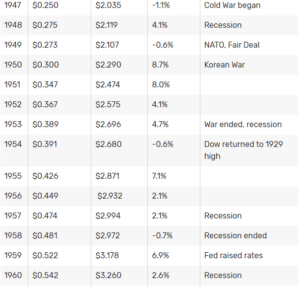

However, in 1913, US administrative efforts against approached the same issue and declared 1% corporate income tax for the corporates (Seidman, 2004). With the start of the First World War and continuous economic ups and downs, corporate income tax arises up to 15% until the start of the World War II (Seidman, 2004). As reader can see, before the Great War, US companies mostly held an adverse position against the corporate income tax and perceived it as a constraint tax, and a burden for their own benefits, however, with the start of the turbulence in the global politics, state’s reorganisation of their fiscal status and tried to prevent any major fiscal distress to their treasuries during the period of war, through impose of such tax in increased rates, companies only cope with such activities.

However, at the short term such activities can be considering as a right thing to do in order the strengthen the fiscal budget, but as can seen in the historical records, US government continued to increase those taxes year by year, and during the World War II, these rates jumped nearly into 50%, and US government received 20% of its revenues from such corporate income taxes (Seidman, 2004). Such events needed to some evaluations in order to understand the tax policies in cyclic assumptions. As Ibn Khaldun stated, with every crisis and change of the way of life, state’s expenditures are growing and this expansion consequence with the increase of the taxes, in other words, global turbulences billed to the domestic producers and regular taxpayers, as a result, we can need to see decline in production as a reaction. Best way to analyse such declines are analysis of the GDP changes across the years as follows.

As can be seen on the figures, only two digits increase in the GDPs are the period in 1941-1943, where the US mobilise its full forces in order to actively participate in the war, and such jump in the increase of the GDP can be explained through the war economy. On the other hand, from 1929 to 1960, corporate income taxes moved around between 15% to 50%, and GDP growth rates are mostly negative, or low one-digit growths occurred. Again, only specific high level of increase in the GDP growth occurred during the 1949 and 1950, which correlates with another war, Korean War, which was perceived as national security threat for the US. According to the Khaldunian approach, such dramatic increases are ended up with the Laffer Curves, which means the increase in the tax rates consequence with the decline of the tax revenues.

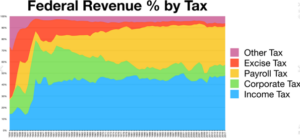

As can be seen on the table above, we can clearly say that the, corporate income tax revenues started to decrease with the year of 1952 in the federal revenues, as a result of the increase of the corporate tax rates in the US. This can explain in the terms of the constraint-tax concept and the culture of corporate. As mentioned above, constraint-taxes are considered as a burden for the taxpayers that are not legitimate and left a question in the minds of the taxpayers. In this regard, corporate income taxes are considered as a burden for the companies.

On the other hand, there is also another point, corporates are not only economic unit of the system, but they are also having a political side, especially in the US. Until the 1913, magnets, cartel industries and the monopolies are so widespread in America that, government forced them to split into minor companies. With the increasing tax rates and declining profits, they found themselves in a dead-end. Either they use their lobbying forces in order to decline these rates as did in the 1894, however, times are now changed and US government pursue a world hegemony against the Soviet Union, which that was not an option, or shut down their business and move into the overseas in order to re-organise their profits. As one can see, with the start of the 1952, near-end of the Korean War, federal revenues acquired through the corporate income taxes started to decrease, this can be also an evidence for our study that the US companies started to move around overseas in order to avoid high-taxation and regain their profits, or another option, they started to financialise their capital rather than the increase the production-capital.

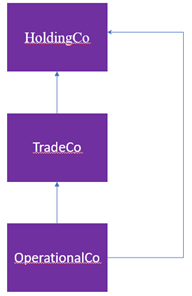

Companies, in order to avoid such high-taxation and try to stop further-profit loss, they started to move into two options; restructure of their company organisation for tax efficiency based on tax avoidance principles or move into the capital companies and let loose the production capacities of theirs. During this period, two areas emerged as a tax haven for the company’s search for avoidance. On the one hand, there were traditional tax havens derived from the British Empire-based locations such as Bermuda, Caymans for the offshore financial centres, on the other hand, there was emerging economies, with ties of the colonialism, such as Hong Kong and Singapore became a main holding location (Palan and Murphy and Chavagneux, 2009). However, please also note that, financialization of these companies strictly correlated with the use of holding structures in overseas as illustrated below.

As illustrated, profits derived from the operational companies transferred through a trade company, mainly formed as a Joint Stock Company or Limited Liability Company according to the local legislations, hence trade company’s main aim is the moving the profits to the holding companies, or financial offshore centres, which is located in either emerging economies or in the British Empire-based tax havens which were colonial parts of the Britain (Palan and Murphy and Chavagneux, 2009). However, such tax avoidance attempts also supported by the Bank of England, thorough the transactions executed by British banks on behalf of a lender and borrower who were not located in the UK, were not to be officially viewed as having taken place in the UK for regulatory or tax purposes, even though the transaction was only ever recorded as taking place in London. The reason of the Bank of England took such a huge step in the tax avoidance rules, in order to benefit from the potential cash pooling to the Britain’s economy from foreign jurisdictions, that have high tax rates, which was devastated by the Second World War.

Main relation between the state and the company can be understand in dialectic way. While states try to impose high taxes in order to benefit from the economic enlarging periods of the companies, companies are moving into other jurisdictions, with adequate amount of capital, they turn themselves into the capital companies through restricting. The main reason of the companies attempts for financialization of their systems is the problem of high taxation in national jurisdictions, which lowering the profit rates of the companies from such production. Moreover, financialization is also beneficial for the companies due to increasing level of capital mobility, through such a mobility, companies are become able to avoid state’s taxation rules with financial moves, such as shareholder loans, indebtment of the company through shareholders. Moreover, financial mobility seen beneficial from the state’s perspective in the short term during the times of crisis. Such mobility increases the short-term assets, assets that have high liquidity, brings more cash into the economy, and ended up with monetary enlargement, which lowering the interests, and also increasing the revenues derived by taxes.

This progress in short term, seen beneficial in order to avoid fiscal distress from the perspective of the state. However, in long term, such monetary enlargement brings inflation, and when the companies started to establish and maintain their holding system, economic system ended up with the decreasing revenues, and creating low level trusts against the state’s economic mechanisms that ended up with increase of the cash-hold by the citizens. Eventually, allowance for a holding establishment in foreign jurisdictions, tax havens, create huge problem for the core countries, as now we can see on the 2008-2009 economic crisis. In order to understand the core of the problem, we need to focus on two things; core-periphery systems in the world economy and the fiscal distress bring by the financial crisis on the core countries.

B) Financial Crisis And Change In The World System

With the Great Recession, emerged due to high-risk subprime lending in real estate sector, shake financial systems of the notably Western core states, starting from USA and spread the UK, Germany, France etc., Marxist writers saw the crisis as a result of the long-term tendency of the rate of profit fall, in other words, the problem was the inability of capital to grow or accumulate at sufficient rates through productive investment alone (Roberts, 2011). Low rates of profit in productive sectors led to speculative investment in riskier assets, where there was potential for greater return on investment. With the failure of the banks and seeing the fact that markets do not fix themselves in a short term, as Friedman argued, after the crisis, there was a Keynesian resurgence occurred.

Keynesian economics believed that the money is unstable due to its nature of use, speculation, and in order to stabilise it, there is a need for state involvement based on the fiscal stimulus and expansionary monetary policies (Reddy, 2009). These expansionary monetary policies are also including increase of the taxes, in order to regain the stimulus in the economy through decreasing the demand inside the economy. As author mentioned in the previous section, state’s main mechanism is the satisfaction of its actors, through maintaining a habitat for them. With the Great Recession, countries such as US, UK or Germany faced with fiscal deficiencies inside their economies that leads to massive protests and unemployment’s that could polarise the entire political system and led to political upheavals (Wolfers, 2011).

On the other hand, countries such as Spain, Greece or Italy faced with the debt crisis, that already effect their political systems, such as happened in Greece, with the debt crisis, political atmosphere also started to change, unemployment’s led to riots and Greek people started to seek other political alternatives for themselves such as the SYRIZA, a coalition of the radical left, which was eventually became ruler in 2015 (Copelovitch and Walter, 2016). As can be noted, main problem was not the crisis itself directly, it was the state’s unpreparedness for such a fiscal burden in order to protect their own habitats. With the start of the Great Recession, core of the world-economy faced with unprecedented pressure on their fiscal systems. In order to avoid such important problem, in order to maintain their habitats and keep the satisfaction as requested, state’s pursued expansionary monetary policies. In this regard, two important terms need to be discussed; core in the world-economies in financial level, and how taxes affect such core-periphery relations.

World-systems theories mostly focused on the trade relations between states and productional capacity of these states in order to determine the economically strong state. In this regard, core economies classified as strong bourgeois and working classes, industrialised, diversified economies that generate wealth. industrialised, diversified economies that generate wealth. However, on the fiscal level, there is also one thing needs to be considered: tax capacity of these states. As Turchin showed in his book (2016), states in order to avoid any political destabilisation, they need to consider the state’s financial distress. State’s financial distress can be seen in a formula as below.

SFD= Y/G(1-T)

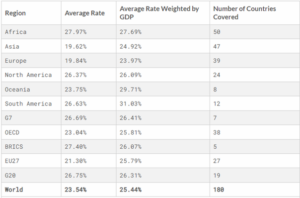

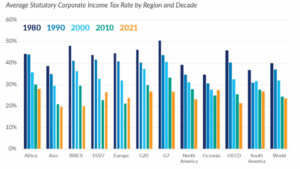

The term Y represents the total debt of state, while G represents the GDP, and T represents the total trust to state by citizens. Trust bonds between state and society can heavily affect the state’s revenues and in order to avoid such problem, states must be maintaining a satisfaction to its citizens. Moreover, if we turn back our world-economy, world-system analysts are mostly focused on the production, trade relations and trade-surplus alongside with the increasing investments into the country rather than the evaluating the monetary policies. However, fiscal structure is also important for the state in order to continue their core dominancy and their institutions which are praised by the world-system scholars. In this regard, tax needs to be evaluated as a main source of fiscal equilibrium of the state. When we look at the core state’s, in the perspective of the tax, there is three important elements in order to gather taxable revenues. First of all, due to diversification of the economy, they allowed group mechanisms inside their tax systems, which means, subsidiary operational companies are allowed to deduct their expenses on behalf of the holding company. Secondly, core state’s mostly have large tax-bases, which in return gather enormous tax revenues from their citizens. However, please note that, such tax base is large not the reason of high tax rates, but due to great numbers of registers to their revenue administrations. You may find the average tables as follows.

As you can see, average rates in Europe, one of the most classical core regions in the world-economy can be seen as one of the lowest rates, however, on the other hand, reader may confuse why North America have such a bigger average rate compared to the other core regions. As reader can see, there is no such a big difference between the tax rates, or high tax impose done by the tax authorities in the core countries. When we compare the G7 countries and BRICS countries, there is only a minor difference arose in terms of the rate of the taxation. Moreover, there is also global effort for the decrease the tax rates. Within the four decades these rates declined from 40-50% to 20-25% and the further decreases are predicting by the OECD. Decreasing the tax levels can be analysed in two ways from the perspective of the world-economy. First of all, such decreasing trends coincided with the capital accumulation crisis of the world-capitalism, and accumulation crisis led to capitalists to pursue other jurisdictions in order to continue their business, however, majority of these capitalists emerged and maintained their business in core regions, US and Europe, and their capital mobility from this region to others ended up with weakening fiscal position of these states, as mentioned in the mechanisms of the holding company above.

For avoiding such problems, core states incorporated the lowered corporate tax rates for the sake of their revenues. Secondly, such decreasing trends are crucial for the core states in order to compete against the developing states. In the first analysis, capitalists made their choices through rational model, which means they believe that the in order to avoid tax, they should move on foreign jurisdictions where the tax rates are minimal, due to their capital mobility thanks to foreign financial centres or holding companies. In this regard, this group is mostly financialised and seeking for the optimal solution for their needs. On the other hand, in the second analysis, developing countries also tries to attract producers, industrial magnets to their country through incentives. Tax incentives through production inside the local jurisdiction mostly beneficial for the operational companies in order to lowering the expenses and increasing the profits.

Such incentive schemes can be seen in the Turkey, India, Brazil, Argentina etc. With these incentive plans, developing countries, semi-peripheral states, tried to relocate the global capital to their jurisdiction and pursue a policy of industrialisation and diversification of their economy. Please note that, such incentive plans not always have to do with industrialisation, many incentive plans also maintained for the service sectors for the sake of the diversification of these economies. In this regard, core states are continuing to maintain lower corporate tax rates in order to compete against the lower or zero tax rate jurisdictions provided by the peripheral countries and incentive plans developed by the semi-peripheral countries. Such competitiveness for the capital mobility is naturally consequence with the lowered rates of the corporate tax rates and establishment of the participation exemptions by the core countries. In this regard, one of the most successful examples of this issue is the Netherlands, while on the one hand, maintained corporate tax rate at the 25% level, maintained many exemptions for the profit distribution in order to stay attractive for the capital mobility around the world. Many developing countries, including Turkey, and their capitalists still see Netherlands as a holding centre, which is a opportunity for the enlarge their operations to the world.

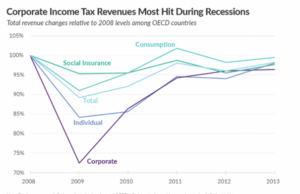

With the Great Recession, core countries faced with huge delinking process from its citizens in political manners, such as the giving bailout funds to big companies but such bailouts used as promotions and prize moneys by the companies to their managerial staffs, or reluctant position towards the inflation, while citizens demanding domestic reforms, states impose international agendas which accelerate the immigration crisis and global flow of workforce, intervention to the another states jurisdictions and their affairs with the another countries, such as in the example of the Iran-US affairs, despite the recessionist threats arising form financial sectors in 2009 and 2010, US still continued contamination of Iran policy as a priority and moved this issue to the UN. Such ignorance against the citizens ended up with decreasing trust between state and society. This low level of trust also correlated with the state revenues. With the risky environment, citizens cut their investments to the bonds, which is one side of the revenue problem for the states. Moreover, from the perspective of the tax, revenues started to decrease as a result of this recession and decreased trust levels as can see below.

These companies do not face with massive shutdowns, as did on the Great Depression before, so what happened to all that money? They moved their capitals to the zero tax jurisdictions or developing countries in order to avoid the burden of the increasing expenses in the core countries. James Henry’s estimation is the total up to USD 36 trillion hidden in the tax havens (2016). Moreover, the average tax revenue as a portion of GDP hit 32.7% in 2009 its lowest level in nearly two decades. Beyond that, tax revenue in cash terms shrank in nearly all member states. Only Switzerland, Luxembourg, and Turkey escaped the cash crunch that year. In order to cut such evasions and avoidance from the tax, for the sake of the maintenance of the state’s fiscal status and remain as a core position in the world-economy. To do this, with the initiative from the OECD, G20 countries created the BEPS Action Plan, in order to fight against the tax evasion and tax avoidance done by the multinational companies.

C) BEPS Action Plan: How To Maintain Core

BEPS action plan aimed for the mitigate tax code loopholes and country-to-country inconsistencies so that corporations cannot shift profits from a country with a high corporate tax rate to countries with a low tax rate (OECD, 2013). BEPS Action Plan planning for the cutting double taxation and double non-taxation in order to avoid companies profit shifting mechanisms and provide a systemic tax base for the globe (OECD, 2013). However, the aims itself can be regarded as a question in itself. First of all, BEPS plan claiming the end of the double taxation in different jurisdictions in same business. However, states since the end of the Second World War, tried to abolish such harmful practices through the Double Tax Treaties signed bilaterally. In Double Tax Treaties, in order to avoid double taxation, states maintained their right to tax privilege in certain articles, both in the business establishment and profit transfer from one jurisdiction to another. For example, Turkey today have 90 Double Tax Treaties signed with foreign jurisdictions in order to avoid such Double Taxation issues (Gelir İdaresi Başkanlığı, 2022). In this regard, OECD’s position on the “end of the Double Taxation” is not very sophisticated and new way of thinking. On the other hand, cutting non-taxation is another problematic issue in the BEPS plan.

Planning for a control of the tax havens in order to maintain global fiscal strength can be regarded as beneficial for all the states, however, BEPS Action Plan is not mainly focused on such thing. Most of the structures that considered as problematic by the OECD is either derived from the company’s rights given by the Double Tax Treaties or jurisdictional local legislations and their exemptions. For example, Double Irish method in order to avoid high tax rates, mainly consisted of the corporations with intellectual property (“IP”), which are mostly technology and life sciences firms, can turn this into an intangible asset (“IA”) on their balance sheet, and charge it out as a tax-deductible royalty payment to end-customers (Dharmapala, 2014).

The Double Irish enables the IP to be charged-out from Ireland, which has a large global network of full bilateral tax treaties. As can be seen, flowing out of the capital from US to Ireland, which has many tax incentives to the technological outputs under the terms of intellectual property. Moreover, such policies regarded as base erosion according to the OECD, however, in order to can be clarified as a base erosion, first of all, such companies need to be pay zero tax, mainly establish on the tax havens such as Caymans or Bermuda, however, in this scenario this is not a case.

Companies such as Apple, Microsoft, Starbucks, Pfizer or IBM regularly used such plans, and they are all regular taxpayers in both countries. Moreover, with establishment in location such as Ireland, which is semi-peripheral state that right next to the UK, technology transfer from US to Ireland also emerges which can contribute to the catch-up policies in development terms, alongside with the capital reallocation. The main reason of OECD calling such activities as a base erosion, it is reasoning that capital, and its taxable part, flowing out from core states such as US to semi-peripheral states, such as Ireland. Due to that reason, in order to avoid such “erosion” of the tax base, they also developed Pillars in order to determine which jurisdiction able to tax which capital.

In 2021, OECD introduced new 2-pillar solution for the base erosion and profit shifting. The scope of pillar one is in-scope companies are the multinational enterprises (MNEs) with global turnover above 20 billion euros and profitability above 10% (OECD, 2021). In order to determine tax base, this pillar distributes MNEs’ excess profits to regions where consumers or users are concentrated, regardless of whether the enterprises are physically present there. The amount to be distributed will be calculated as 20–30% of the remaining profits of the enterprises included in the scope.

However, while thinking world’s most of the GDP produced by the G7 states, at the most distributable period G20, such policy means that most of the taxation rights directly moves into the mainly core states and very small portion of it moves into the developing countries. Such inequality in the taxation principals will further alienate the semi-peripheral groups and further accelerate the use of tax havens by the companies with certain incentives granted by the developing nations. Moreover, categorisation of these countries is also problematic. 20 billion EUR worth companies mostly consisted of the western core nations, such as US, UK, France, Germany, with the certain exception to Russia, Japan and China.

With such categorisation, OECD directly gives the right of the taxation to the core nations and restricting capital mobility in local jurisdictions, because as per the pillar provides, with such expansion to other jurisdictions, this will bring more taxation for the multinational companies since with the OECD’s aim for the end of the Double Tax Treaties, MNEs will not benefit from the certain exemptions or privileges that granted to them through these bilateral agreements. Due to that reason, as reader can understand, pillar one tried to hold big multinational companies in home in order to benefit from their revenues as a taxable resource for the maintenance of their fiscal status.

Second pillar, however, represents another important development in the taxation field. Pillar Two introduces global minimum tax rate of 15% for the multinational groups with revenues more than EUR 750 million (OECD, 2021). The link between parent MNCs and their subsidiaries is discussed. If the MNC’s subsidiary has low-taxed income, the MNC will need to pay a top-up tax to raise the income’s applicable tax rate to 15%. Please note that, subsidiaries based in tax havens are now exempt from paying taxes or only pay a minimal amount. This process maintained by the three important rules; inclusion rule (IIR), the undertaxed payments rule (UTPR) and the subject to tax rule (STTR).

The main regulation is the IIR. It will be used and paid for in the parent MNC’s country of residence (OECD, 2021). It won’t, however, apply to the actual head office. If the effective tax rate of all the merged firms and branches in each jurisdiction falls below the minimum tax of 15%, this rule establishes a top-up tax that is charged to the head office. On the other hand, subject to tax rule propose that, standardization of the levied tax on the certain payments at certain levels between 7.5% and 9% (OECD, 2021). In sum, countries which have lower corporate tax than the 15% may lose their taxation rights under these rules and moved on other jurisdictions easily. Second pillar can be analysed in three ways in terms of the core periphery relations. First of all, such policies strengthening the core nations fiscal power in the world politics. Core countries over the four decades systemically decreasing their corporate tax rates and tried to maintain big holding companies under their local jurisdiction.

In 2018, US also introduced tax reforms in order to stay attractive for the big companies in terms of the headquarters and operational level. This of course happened due to compete against the developing countries in order to stop capital flows from core to periphery. In this regard, core countries with amending such pillar, forcing capital mobility to “stay at home” for their further dominance and gather adequate revenue for their dominance over the world politics. Secondly, states such as UAE, developing countries, for a long-time attractive finance centres for various capitalists, due to low tax rates. However, with the implementation of such rules, their attractiveness will be lost due to low tax rates than the foreseen by the pillar two, and eventually capitalists will pay their taxes at one level or another. As a result, their development program, which is strictly related to the foreign direct investments, halted or slowed down.

This brings status quo to the system, a brief moment for the core countries in order to revenue accumulation and establish a barrier for the developing countries process. As a result, multinational companies will gradually become less multinational, limiting their zones to the European Union zone and North America, which both are maintain their regional tax incentives intact. And with the withdrawn from the other regions, apart from the operational companies, capital flow to these regions will be restricted and development will be slowed down. Thirdly, such action prevents most of the tax incentive programmes and policies provided by the developing countries. Pillar Two provides certain level of taxation to certain activities, such as royalties, that means the any tax incentive program, which reducing the tax rates temporarily or granting tax-free programmes will be null and void from the perspective of the investors. Because if certain tax levy will not be made, taxation right moved into another company in the multinational chain. So why they bother themselves for such problems, if they pay taxes at the same level, why do they choose Turkey, instead of US, Netherlands, UK?

D) Conclusion

For states, tax is very essential part of the revenue due to establish a stable environment for their citizens in order to avoid any political upheaval or discontent threat. On the other hand, one of the revenue relations of the state establish with the companies. While evaluating the company and state relations in terms of the taxation, due to company’s main aim, search for the accumulation of profit, and state’s hunt for the any revenue that it can be able to collect, made this relation very conflictual. In order to avoid such tax problems, companies are generally used holding structures through financialization of their structure, moving production to finance. Generally, they establish foreign holding structures and transfer their profit’s foreign favourable locations and continue their business. These favourable locations can be either tax havens, peripheral zones, or can be developing countries which are competing with the core countries and proposing tax incentives, establish widespread bilateral tax incentives in order to attract capital from other jurisdictions.

With the Great Recession, core countries faced with huge fiscal distress that threatened their domestic political legitimacy from the eyes of their citizens. In order to prevent total rebellion, as did on Egypt, Libya and Syria, they started to enlarge their revenues for the continuation of the circus and bread policies. To do so, they introduced the BEPS Action Plan, which delegitimize the older benefits of the bilateral double tax treaties, and tax exemptions provided by the local jurisdictions. Moreover, they also introduced pillar system, which forcing investors to stay in national jurisdiction and try to delegitimize every aspect of the previous tax incentives and exemptions provided by the states. Furthermore, with these pillars, they also try to implement a global corporate tax level, at 15%, and throughout the rules, they imply that the, developing countries needs to increase their corporate tax levels in order to held their taxation rights which means restriction for the developing nations in terms of the foreign direct investment plans from abroad. This will be led to hold developing countries progress and eventually consequence with the long-term core dominance over the developing nations.

https://stratejikortak.com/author/eneskaynak

BIBLIOGRAPHY

Ronen Palan, Richard Murphy and Christian Chavagneux, Tax Havens: How Globalization Really Works, Ithaca: Cornell University Press, 2009.

F.K. Mann, “The Sociology of Taxation.” The Review of Politics 5: 225-235, 1943.

Sudeep Reddy, “The New Old Big Thing in Economics: J.M. Keynes”. The Wall Street Journal, 08.01.2009

Justin Wolfers, “Mistrust and the Great Recession”, Freakonomics, 09.03.2011

M. Copelovitch, J. Frieden and S. Walter, The Political Economy of the Euro Crisis. Comparative Political Studies, 49(7), 811–840. (2016)

OECD (2013), Action Plan on Base Erosion and Profit Shifting, OECD Publishing. http://dx.doi.org/10.1787/9789264202719-en

Dhammika Dharmapala, “What Do We Know About Base Erosion and Profit Shifting? A Review of the Empirical Literature”. University of Chicago, 2014.

J. O’CONNOR (1973). The Fiscal Crisis of the State. New York: St Martin’s Press.

J. Webber and A. Wildavskyi, A History of Taxation and Expenditure in the Western World. New York: Simon and Schuster, 1986.

Abd al-Rahman ibn Muhammad Ibn Khaldun, Muqaddimah, Routledge & Kegan, 1978.

Talcott Parsons, The Social System, Routledge, 1991.

Sol Picciotto, International Business Taxation, London: Weidenfeld and Nicolson, 1992.

J. S. Seidman, Seidman’s Legislative History of Federal Income Tax Laws: 1938-1861, The Lawbook Exchange, Ltd., Clark, New Jersey, 2003.

[/vc_toggle]